PlayAGS Stock Inexpensive Despite Attractive 2023 Outlook

Posted on: April 4, 2023, 09:37h.

Last updated on: April 4, 2023, 02:07h.

PlayAGS (NYSE: AGS) stock entered Tuesday with a year-to-date gain of 43.14% — good for one of the best performances in the gaming equipment space — but some analysts believe the shares could generate more upside over the course of 2023.

Following recent virtual meetings with PlayAGS CEO Dave Lopez and other executives, Stifel analyst Jeffrey Stantial came away constructive on the stock, citing factors such as steady wagering trends, a strong product pipeline, and improving relationships with high-level corporate customers, among other factors.

Based on AGS’s geographically diversified recurring revenue footprint, real-time discussions with operator customers, and monthly state-reported GGR data, management cited stable wagering trends thus far into 2023,” noted Stantial.

That’s an important observation because there’s concern that macroeconomic headwinds could compel consumers to rein in gaming-related spending. Stantial reiterated a “buy” rating and a $10 price target on slot machine manufacturer shares, implying an upside of 37% from the April 3 close.

PlayAGS Stock Hot, but Cheap

With a market capitalization of $268.84 million, PlayAGS qualifies as a small-cap stock and a growth name. Combine those traits with the aforementioned year-to-date rate, and it would be reasonable to believe valuation is stretched on the stock. That’s not the case.

Additionally, the investment thesis could be supported by the expansion of tribal gaming clients in Florida, Texas, and Oklahoma. Plus, the shares are noticeably cheap.

Valuation continues to lag peers, mostly reflecting concerns on leverage & misleading optics around a late-2022 secondary sale. We see this discount further closing as proof points on improving execution & fundamentals accumulate,” added Stantial.

Another point in favor of the stock is strong sales visibility as far out as three months, indicating the strong topline trends seen to start the year could carry over well into the second quarter.

“Encouragingly, management cited a robust for-sale pipeline into Q2 (typically 60-90 days of visibility), suggesting operators continue to let stable underlying demand trends drive slot floor reinvestment decisions rather than concerns on an uncertain macro outlook,” said Stantial.

PlayAGS Changes Benefiting Stock Price

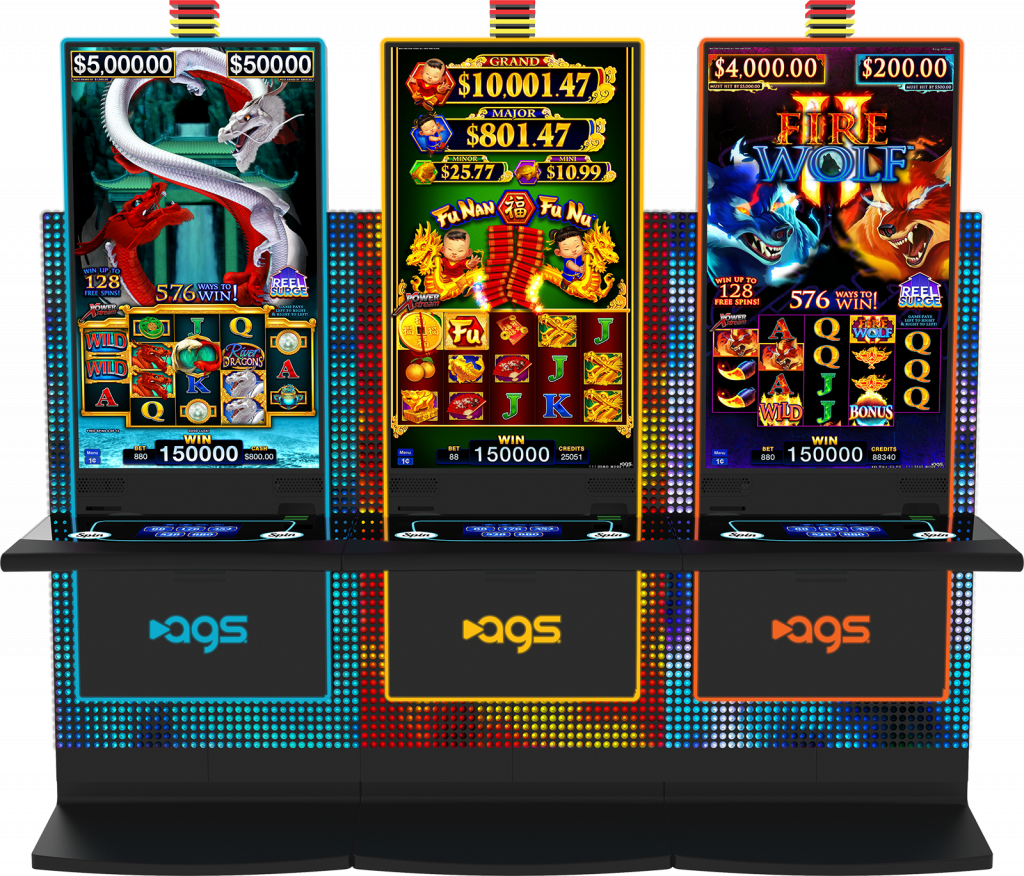

In addition to efforts to dramatically reduce leverage, PlayAGS is taking steps to correct errors made in its infancy as a public company. That’s to say, the slot maker is investing more in research and development and taking steps to wrest market share from rivals.

While still early, we’ve begun to see these changes translate to improved operating momentum specifically highlighting 1) >4% ship share (adjusted for Canada/Oregon VLTs) for six consecutive quarters 2) seven consecutive quarters of >100 units of sequential growth in premium leased installations with Y/Y growth in Q4 leading the peer group, and 3) six consecutive quarters of >20% Y/Y growth in Table Products adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA),” concluded Stantial.

Additionally, PlayAGS’s improving fundamentals could support the stock if casino operators scale back slot purchases in the second half of this year due to trying economic conditions.

Related News Articles

Source: casino.org